Now that summer is in full swing, you might have some fomo watching all your friends go on fab trips or you are enjoying your trip and already planning the next one.

Either way, the new Chase Sapphire offers could help you make those vacations super affordable. We don't know when this latest offer will end so it's better not to wait.

Chase announced three whopper deals on its Sapphire line of credit cards. We will detail these for you and help you decide if you should jump on any of these offers. We knew the Chase Sapphire Reserve credit card was undergoing a refresh and you can check the details here to see how you will be affected if you already hold the card. It's good!

- Chase Sapphire Preferred - Bonus offer 75,000 points (valued at $750) with a $5,000 minimum spend in three months. This is our all time favorite travel credit card. Annual fee of $95 and it comes with a $50 hotel credit when you book through the travel portal. You earn 3x points on dining, 3x on online grocery, 2x on travel, 5x on travel booked in the Chase Travel Portal and 1x on everything else. It also comes with a $120 DoorDash credit and points boost when you book in the Chase Travel Portal.

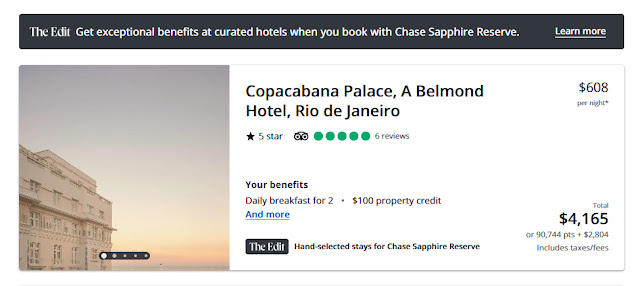

- Chase Sapphire Reserve - Bonus offer 100,000 points (valued at $1,000) with a $5,000 minimum spend in three months. This was our all time favorite premium travel credit card, but it now has an increased annual fee of $795. We still think it's a great deal, but you need to make certain that you will use the credits to make the high annual fee worth it. We detailed the credits and benefits of the new refreshed card here.

- Chase Sapphire Reserve Business - Bonus offer 200,000 points with a $30,000 minimum spend in six months. This is a brand new card and if your business can swing the spend, it's a great deal for you. You can squeeze as much as $4,000 value out of those 200,000 points. Plus annual credits on the Chase Travel Portal, DoorDash, Zip Recruiter, Edit Hotels, Google Workspace, Lyft and more.

Want more personal help using points and miles for almost FREE travel? Join my Travel Coaching Program and we will design your personal strategy to travel for almost FREE and guide you through the process. Right now, you can use the promo code "FREETRAVEL" to get $50 off the program. Not ready to dive into th coaching program, download the ebook or custom tracker or book a 1:1 consulting call with me. I would love to help you make priceless family memories affordable.

*For every new client, we will donate 10% of the proceeds to one of our favorite charities.

.png)

.JPG)

.jpg)

.jpg)

.png)

.png)

.png)