Sunday, April 20, 2025

Already Have the Chase Sapphire Preferred? Here’s How You Can Still Get the 100,000 Point Bonus

Monday, June 27, 2022

How You Can Stay At An Airbnb For FREE

- Airbnb

- charitable contributions

- dining (with the Sapphire card only)

- membership fee (with the Sapphire card only)

- Log into your Chase.com account

- click on the card you want to transfer points FROM

- click redeem points

- then click on the three little lines at the top left

- scroll to the bottom

- click combine points.

Friday, December 11, 2020

The Trick To Getting More Value Out Of Chase Ultimate Reward Points

So here's the trick to get more value out of the points.

- Just log into your Chase.com account

- Click on the earn/use points and you'll see this dashboard. It's expanded a lot since the pandemic started. One of the things I love about Chase is how user friendly the site is. You can see exactly how many points you have, how to use them, and how to earn them.

- Click on combine points and you will see the option to move points from one card to another. You can also move points from one family member to another if your family member only has a no fee card or even a Preferred card.

Tuesday, June 9, 2020

How To Pay Yourself Back With Chase

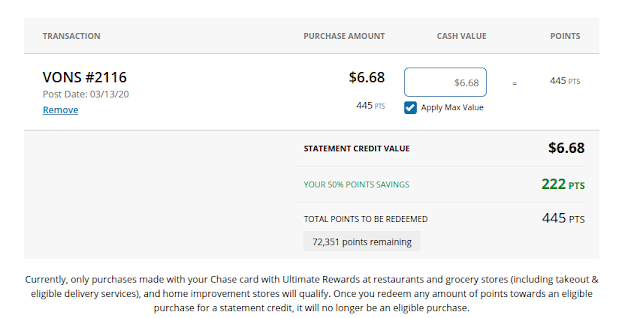

An exciting new perk offered by Chase Sapphire Reserve and Preferred credit cards is the option to pay yourself back with your points.

How To Pay Yourself Back With Chase

The beauty here is that you still earn the Ultimate Reward points on your grocery, home improvement, or dining purchase and then you erase it with the extra value. When you book travel through the Chase portal, you also get the extra value, but you don't earn Chase points and you don't earn airline miles or hotel points. That's because Chase uses Expedia as its portal so you are making your reservation through a third party.

You have 90 days after your purchase to essentially erase it with points and you can pick and choose from the list.

1. Log in to your Chase account

2. Click on redeem points

3. Click on earn/use points at the top left of the screen

4. Click on pay yourself back

At this point, since you might not be traveling, it might make more sense to erase grocery, home improvement, and dining purchases and then buy your travel. You get the bonus when you erase those purchases and then you double dip by getting points again when you pay for your travel. If you decide to apply for the Chase Preferred credit card, please consider using my referral link and supporting my blog. Right now, you can get 50,000 points when you spend $4,000 in the first 3 months. That's about $625 in travel, groceries, home improvement or dining. Awesome!

Thursday, July 13, 2023

How To Squeeze More Value Out Of Your CUR Points

The Chase Ink Business Preferred and the Sapphire Preferred gives you 25% more for your points in the pay yourself back and Chase Travel Portal, but the Chase Sapphire Reserve gives you 50% more.

How To Squeeze More Value Out Of Your CUR Points

So here's the secret. Chase allows you to combine your points from one credit card to another. So you can easily move your points from your FREEDOM FLEX or Unlimited card to your Sapphire Preferred or Chase Sapphire Reserve to get more value.

- Just log into your Chase.com account

- Click on the earn/use points and you'll see this dashboard. It's expanded a lot since the pandemic started. One of the things I love about Chase is how user friendly the site is. You can see exactly how many points you have, how to use them, and how to earn them.

- Click on combine points and you will see the option to move points from one card to another. You can also move points from one family member to another if your family member only has a no fee card or even a Preferred card.

Chase will ask you how many points you want to move, review your order and bam, instant transfer.

How To Squeeze More Value Out Of Your CUR Points

Now you can use those points for travel or to pay yourself back for any qualified purchases you made in the past 90 days.

If you decide to apply for the Chase FREEDOM Flex, Sapphire Preferred, Sapphire Reserve or Business Ink please consider using my referral link. You get the same bonus and I also get a small bonus for referring you. That's how we do it at almostFREEfamilytravel.com

Monday, May 30, 2022

Last Chance To Earn That 80,000 Chase Sapphire Preferred Bonus Offer

Last Chance To Earn That 80,000 Chase Sapphire Preferred Bonus Offer

Last Chance To Earn That 80,000 Chase Sapphire Preferred Bonus Offer

- spend $4,000 in three months

- $95 annual fee

- $50 annual hotel credit when you book through the portal

- 5x Chase points on travel booked through the portal

- 2x Chase points any travel purchases

- 3x Chase points on online grocery purchases

- Chase points are worth 25% in the travel portal and when redeemed through the pay yourself back tool in rotating categories

- 3x Chase points on dining

- 3x Chase points on streaming services

- 10% anniversary points boost

Friday, February 2, 2024

Unveiling the Chase Ultimate Rewards: Why 23,363 Points in 2023 are Worth Celebrating

Friday, May 31, 2024

Why You Should Jump On This Bonus Offer Before It Ends

We are hearing that the increased bonus offer for the Chase Sapphire Preferred and the Chase Sapphire Reserve credit cards is ending "soon."

Though we don't know exactly when soon is, if you are thinking about jumping on this offer, you should do it sooner rather than later.

These cards are my favorites because Chase Ultimate Reward points are so flexible. You can transfer points to dozens of different airlines, hotels, use them in the Chase Travel Portal or even pay yourself back though I don't recommend doing this.

The Chase Sapphire Preferred and Sapphire Reserve cards also offer great benefits and should have a primary spot in everyone's wallet and travel strategy. The Sapphire Preferred credit card is also an excellent card for a student once they have built enough credit to qualify.

Right now, you can earn 75,000 CUR bonus points with a $4,000 minimum spend. The Sapphire Preferred has a $95 annual fee and the Reserve has a $550 annual fee, but the Reserve card also comes with a $300 travel credit, $100 global entry credit, Priority Pass membership and an increased value for the points in the Chase Travel Portal.

I love CUR points because of their flexibility. You can:

- transfer them to dozens of different airline loyalty programs

- transfer them to several hotel chains (Marriott, IHG, Hyatt)

- use them to buy hotels, flights, activities and car rentals in the Chase Travel Portal

- pay yourself back

- get a statement credit

If you don't have one of these in your wallet yet, this is the time. If you decide to apply, please consider using my referral link.

Tuesday, September 20, 2022

Chase Pay Yourself Back Program Extended To Dec. 31st

Updated September 30th 2022

Chase has extended the Pay Yourself Back categories again, this time through December 31st 2022. You can use your Chase Ultimate Rewards Points to erase Airbnb.com and dining purchases. During the pandemic, Chase.com expanded the ways you could redeem points so not just for travel since we weren't traveling, but also for dining, home improvement and groceries.

They ended the grocery and home improvement categories last year, but extended the Airbnb.com and dining portion of the program.

However, the deadline has been extended so you have until the end of the year to erase those dining and airbnb purchases.

If you have a Chase Sapphire Reserve, you will want to combine your Chase Ultimate Rewards points to this card before you erase purchases. That's because the Reserve gives you a 50% bonus on your points. If you have the Sapphire Preferred, it gives you a 25% bonus so that would be the next choice. If you have the Chase Freedom, Unlimited or Flex card, you don't get a bonus in the Pay Yourself Back program so you should transfer your points to your Preferred or Reserve card. However, there are other reasons to have a Chase FREEDOM Unlimited or Flex credit card.

Once you combine your points,

- login to your Chase online account,

- click on the Preferred or Reserve card,

- click on the three bars in the top left

- click on pay yourself back.

You will see a list like the one above of all your purchases that qualify to be erased and the points needed to do that.

Click on the purchases you want to erase, enter the amount of points you want to use, click confirm and done.

This is way better than the cash back option because you get the 25-50% bonus depending on which card you have. The cash back option is 1:1.

If you are thinking about making some airbnb.com reservations for the holiday or next year, do it now and then erase them by December 31st. That's how we do it at almostfreefamilytravel.com

If you don't have the Chase Sapphire Preferred card yet, this is one of my favorite flex cards, right now the bonus is 60,000 points when you spend a minimum of $4,000. That's like $750 in FREE travel. Please consider using my referral link if you decide to apply for this card.

Tuesday, May 7, 2024

Why You Should Apply For This 75,000 Bonus Offer

Two of the best credit cards for Chase Ultimate Rewards just increased their bonus offer! Woohoo!

The Chase Sapphire Preferred and Sapphire Reserve cards offer great benefits and should have a primary spot in everyone's wallet and travel strategy.

Right now, you can earn 75,000 CUR bonus points with a $4,000 minimum spend. The Sapphire Preferred has a $95 annual fee and the Reserve has a $550 annual fee, but also comes with a $300 travel credit, $100 global entry credit, Priority Pass membership and an increased value for the points in the Chase Travel Portal.

I love CUR points because of their flexibility. You can:

- transfer them to dozens of different airline loyalty programs

- transfer them to several hotel chains (Marriott, IHG, Hyatt)

- use them to buy hotels, flights, activities and car rentals in the Chase Travel Portal

- pay yourself back

- get a statement credit

Wednesday, February 19, 2025

New $1,000 Bonus Travel Offer On Capital One Venture

- Capital One every purchase earns 2 points per dollar

- Chase Sapphire Preferred and Reserve - most purchases earn 1:1, but dining and travel earn 2:1 and there are categories where you can earn 5:1 if you have Chase FREEDOM, FLEX or INK cards.

- Capital One points value are 1:1 when you use them to erase purchases

- Chase Sapphire Preferred values points at 1:1.25 if you use them in the travel portal or as a statement credit

- Chase Sapphire Reserve values points at 1:1.5 if you use them in the travel portal or as a statement credit

- Capital One and Chase offer 1:1 transfer values to airline miles, but Chase offers way more partner airlines and hotels.

.png)

.JPG)

.png)

.png)

.png)

%20(1).png)

.png)

.png)

%20(1).png)

.png)