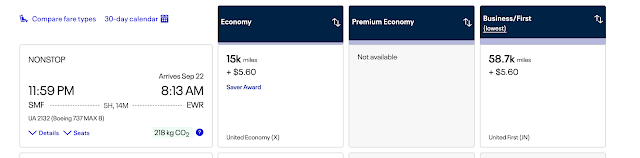

A new client reached out the other day because she wanted to fly across the country to visit her cousins. She had 29,500 United miles, but the flight she was eyeing was charging 15,000 miles each way. Should I buy the extra 500 miles that I need for this trip? And would it be possible to fly premium or business class?

Since this was my first meeting with this client, we needed to find out if she had any other points or miles available. She booked a 1:1 consult through the website. The client said she had a Chase Sapphire Preferred credit card, but had never checked the points balance. Hidden Treasure: How One Client Discovered 275,000 Points She Never Knew She Had

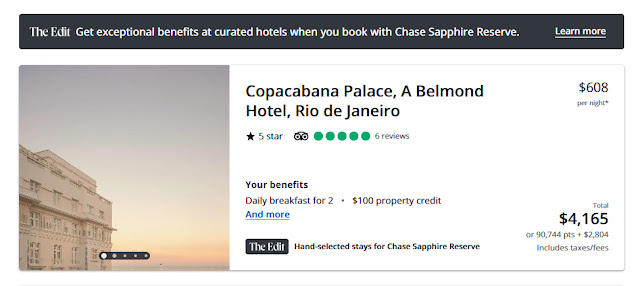

She logged into her account and guess what? She found that she had 275,000 CUR points, wow! "How much are those worth?" she asked. Those points could be worth as little as $3,000 and as much as thousands more depending on how you spend them.

Back to the United flight, premium economy was not available and business class would cost a whopping 117,000 points. Though the client had the points, she didn't want to spend so many of them on this flight. Another option would be to transfer 1,000 CUR points to United to top off the account and buy the economy flight for 30,000 points and $11.40 taxes.

But first we checked the Chase Travel Portal. The same flight listed for 27,798 points. Woohoo! That's even less points than using United miles.

Hidden Treasure: How One Client Discovered 275,000 Points She Never Knew She Had

Done! And she still has 247,000 CUR points to travel where ever she wants to go next and next and next.

Want more personal help using points and miles for almost FREE travel? Join my Travel Coaching Program and we will design your personal strategy to travel for almost FREE and guide you through the process. Right now, you can use the promo code "FREETRAVEL" to get $50 off the program. Or book a 1:1 consulting call. I would love to help you make priceless family memories affordable.

*For every new client, we will donate 10% of the proceeds to one of our favorite charities.

.jpg)

.png)