Small Business Saturday just passed and in honor of that, let's talk about one of the best offers I've ever seen for the Chase Ink Business credit cards. The two FREE cards are offering 90,000 Chase Ultimate Reward points as a bonus and the $95 annual fee card is offering a whopping 100,000 Chase Ultimate Reward points as a bonus. Wowza! I'll run down the difference between the cards in a minute, but first, I have to share with you why I love Chase Ultimate Reward points and what you can do with all those bonus points.

This past summer, I took my family to Ireland, you can check out my blog to read all about this amazing country and people.

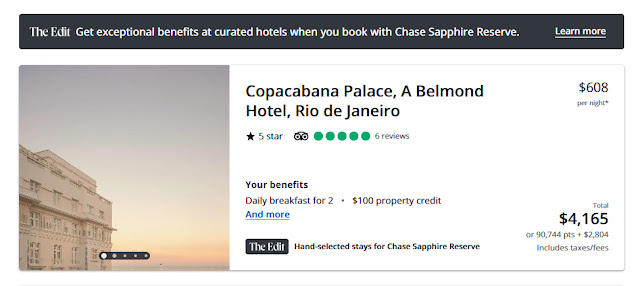

But I used Chase Ultimate Reward points to erase the cost of all of our Airbnb stays during the trip, much of our dining and one plane ticket. I love these points because of how flexible they are. You can transfer them to dozens of airlines, Hyatt, Marriott and IHG. You can erase purchases just like a Capital One card. You can buy travel with them in the Chase Travel Portal. Plus if you have a Sapphire Preferred or Reserve card, you can combine your Ink CUR points and get even more value.

So what's this new offer all about? and which card should you choose?

The Chase Ink Business Unlimited - No annual fee! 1.5% cash back or 1.5x points on every purchase.

The Chase Ink Business Cash - No annual fee! 5% cash back or 5x points at office supply stores, phone, internet, and cable. This is the card I have had for years! 2% or 2x points at gas stations and restaurants and 1% or 1x points at everything else.

The Chase Ink Business Preferred - $95 annual fee. 3% cash back or 3x points on shipping, advertising on social media sites, internet, cable and phone services and travel. 1% or 1x points on everything else.

Look at the types of purchases your business makes to determine which credit card makes sense for you to leverage your spending for maximum points. And remember, your "business" doesn't have to be a Fortune 500 company. A business can easily be selling items on Etsy or Ebay, freelance services, property management, vacation rentals and more.

You can hold all of these INK cards at the same time, but you can't get the bonus on any of these cards more than once every 24 months.

And you can transfer your the CUR points from your INK account to your Chase Sapphire Preferred or Reserve card and bam, almostFREEfamilytravel.

Amazing!

Please consider using our referral ink if you apply for any of these credit cards. Thank you for your support.

.png)

%20-%20chase.com.png)

.png)

.png)

.jpg)