An exciting new perk offered by Chase Sapphire Reserve and Preferred credit cards is the option to pay yourself back with your points.

So what does this mean and why is it so exciting? Here is your step to step guide. The Chase Sapphire Reserve, Preferred, Freedom, Freedom Unlimited, and Ink credit cards all earn Chase Ultimate Reward Points. Personally, these are my favorite points right now just for their flexibility and for the travel portal. They are flexible because you can transfer the points to dozens of airlines, hotels and you can use them to book travel through the Chase travel portal.

And if you are a Preferred or Reserve credit card holder, you get a bonus. Chase will actually offer you extra value on the points so instead of 1:1, you get 1:25:1 for Preferred credit card holders and 1:50:1 for Reserve credit cardholders. Check out my post about why I'm hanging onto the Reserve card.

How To Pay Yourself Back With Chase

And now through September 30, 2020, you also get the extra value when you pay yourself back with points and essentially erase any grocery, home improvement, or dining purchase.

The beauty here is that you still earn the Ultimate Reward points on your grocery, home improvement, or dining purchase and then you erase it with the extra value. When you book travel through the Chase portal, you also get the extra value, but you don't earn Chase points and you don't earn airline miles or hotel points. That's because Chase uses Expedia as its portal so you are making your reservation through a third party.

You have 90 days after your purchase to essentially erase it with points and you can pick and choose from the list.

1. Log in to your Chase account

2. Click on redeem points

3. Click on earn/use points at the top left of the screen

4. Click on pay yourself back

At this point, since you might not be traveling, it might make more sense to erase grocery, home improvement, and dining purchases and then buy your travel. You get the bonus when you erase those purchases and then you double dip by getting points again when you pay for your travel. If you decide to apply for the Chase Preferred credit card, please consider using my referral link and supporting my blog. Right now, you can get 50,000 points when you spend $4,000 in the first 3 months. That's about $625 in travel, groceries, home improvement or dining. Awesome!

The beauty here is that you still earn the Ultimate Reward points on your grocery, home improvement, or dining purchase and then you erase it with the extra value. When you book travel through the Chase portal, you also get the extra value, but you don't earn Chase points and you don't earn airline miles or hotel points. That's because Chase uses Expedia as its portal so you are making your reservation through a third party.

You have 90 days after your purchase to essentially erase it with points and you can pick and choose from the list.

1. Log in to your Chase account

2. Click on redeem points

3. Click on earn/use points at the top left of the screen

4. Click on pay yourself back

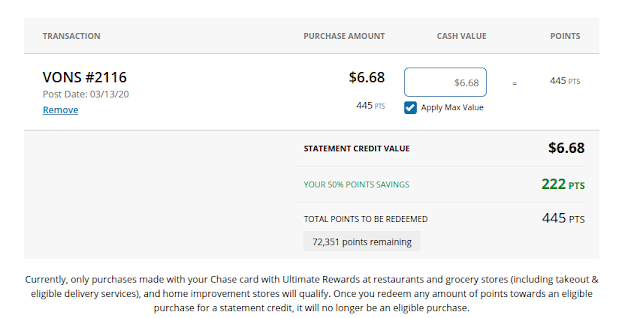

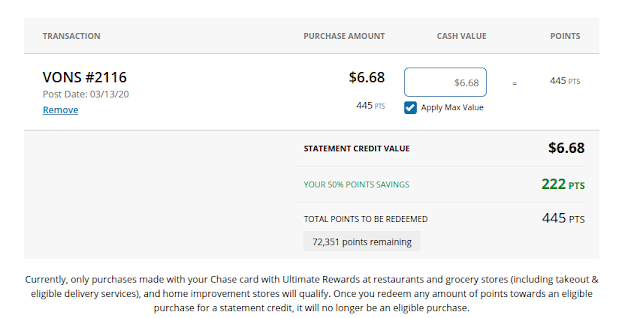

You will see the list above of all your activity that you can erase, just check off whichever ones you want to erase and click on continue. Chase will ask you if you want to erase the entire purchase or just partial and tell you the bonus. Hit confirm and submit. Your statement credit will post within 3 business days. This is very similar to the process used by the Capital One credit card.

As a comparison, you can see on this grocery purchase, I earned 6.68 points because at that point, you just earned 1x points. But when I redeemed points to erase it, it didn't cost me 668 points due to the bonus.

At this point, since you might not be traveling, it might make more sense to erase grocery, home improvement, and dining purchases and then buy your travel. You get the bonus when you erase those purchases and then you double dip by getting points again when you pay for your travel. If you decide to apply for the Chase Preferred credit card, please consider using my referral link and supporting my blog. Right now, you can get 50,000 points when you spend $4,000 in the first 3 months. That's about $625 in travel, groceries, home improvement or dining. Awesome!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.