The Southwest Companion Pass is one of the best perks in travel! It's BOGO travel for up to two years for you and a companion. Did you hear me? BOGO on any Southwest flight anywhere Southwest flies. Costa Rica, yep. Belize, yep. No blackout dates. No blackout flights. All you do is pay the $5.60 for taxes. Amazing!

I have had the Southwest Companion Pass for the past 6 years and it has saved me thousands of dollars. I have traveled to Cuba, Washington DC, Boston, New York City, Florida and a number of college visits, trips, family events and more and taken my companion with me for FREE.

You can even change your companion three times in a calendar year and your companion can be your spouse, child, sibling, cousin, friend, neighbor or whoever you want.

It's Time To Earn The Southwest Companion Pass

The way to earn the Southwest Companion Pass is to rack up 135,000 Southwest points in one calendar year. Once you do that, you earn the pass for the remainder of that year PLUS the following year.

If you time it right, you could have the pass for almost two years. But that's a lot of points! How do you earn so many points? You could fly, but that would be very time consuming and expensive. You could shop through portals and that would help, but again, very expensive.

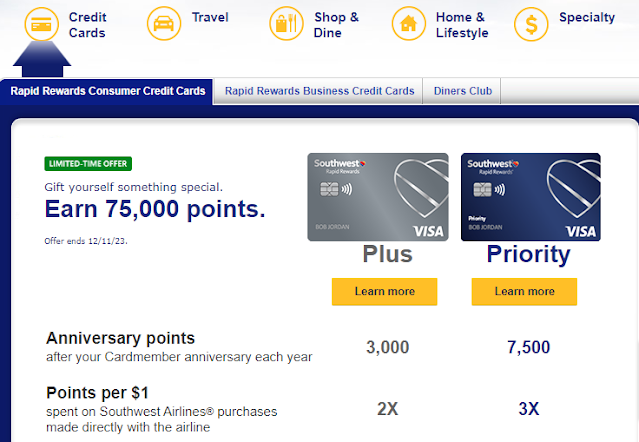

The way to max out the two years is by opening Southwest credit cards. If you open a personal credit card and the bonus is 50,000 points and you open a business credit card and the bonus is 80,000 points then your total is 130,000 points plus 6,000 for the minimum spend and bam, you earn a companion pass. Follow me?

You can click here to see how we do this. And we are going to map out the strategy here and I hope you will come along with me on this journey.

Want The Southwest Companion Pass for 2024-25? Do This Right Now

Let's look at what you need to do month by month:

October

- Cancel your personal Southwest credit card*

- If you have both business Southwest credit cards, you will need to cancel at least one of them.

*You can only hold one personal Southwest credit card at a time and you have to wait at least 30 days to apply for a new personal Southwest credit card. So in order to plan it right, you will need to cancel your Southwest personal credit card this month. I know it can be tough, but it has to be done.

Also you want to confirm that it's been at least 24 months since you earned a bonus on a Southwest personal credit card because you can only earn this bonus once every two years.

You are allowed to hold both business cards at the same time so if you only have one, you are good to go, but if you have both, you need to cancel at least one of them.

I recommend waiting 30 days before you apply for the Southwest credit card again.

November

- Apply for your new personal credit card (you have 3 months to reach the minimum spend, but you can do it faster)

- Apply for your new business credit card (you have 3 months to reach the minimum spend, but you can do it faster)

- You can start using the cards immediately, but DO NOT reach the minimum spend before the statement closes in December or to be extra safe Jan. 1.

- This is the biggest mistake people make and it could cost you a whole year of the companion pass because you earn the pass for the current year and the following year. If your bonus posts before your December statement closes or Jan. 1st then it counts for this year instead of next year. Ouch!

December

- Find out your statement close date on both cards

- DO NOT reach the minimum spend before the statement closes otherwise your points will count towards the current calendar year and not next year

- To be extra safe, hit the minimum spend after Jan. 1st

January

- The goal is to meet your minimum spend as close to Jan 1st as possible, but AFTER your December statement closes.

- Once you reach the minimum spend, your bonus points will deposit into your account

- The deposit will trigger the earning of the Southwest Companion Pass

And bam, BOGO travel for the next two years! Woohoo!

Want The Southwest Companion Pass for 2024-25? Do This Right Now

If you decide to come along with me on this journey or if this post helps you, please consider using my referral links to apply for your Southwest credit cards. Same bonus for you, but I also get a few points for referring you.

The Priority credit card is my favorite! Even though it has a higher minimum spend at $149, it comes with a $75 Southwest credit. The credit can be used to offset the $5.60 fee charged on every ticket and it is applied automatically by the credit card as a statement credit. The Priority also includes 4 upgraded boardings which help if you forget to check in and get in that dreaded C boarding group.

Now if this sounds great to you, but you would like me to personally walk you through earning the pass step by step, join the second cohort of my new Travel Coaching Program. It just opened and there are only 10 spots available. Don't wait, enroll now.

.png)

.png)

.png)

.png)

.png)

%20Facebook%20(16).png)

.png)

.png)

.png)

.png)