One of our best family trips ever was almost a month in Thailand. This trip really launched us into the world of points and miles. One of the credit cards that was on my bucket list was the Chase Sapphire Reserve. This card carries a hefty $550 fee, but here's why I thought it was worth it and now why it's an even better deal.

The Chase Sapphire Reserve falls under the 5/24 rule which means you can only be approved for 5 Chase credit cards in 24 months. It earns Chase Ultimate Reward points which are super flexible since you can use them in the Chase Travel Portal or transfer them to dozens of airlines, Marriott, IHG and Hyatt.

Why I'm Hanging Onto My Chase Sapphire Reserve Credit Card

This card comes with

- a 50,000 point bonus (with a $4,000 min spend in the first three months) which is valued at $750

- a $300 travel credit

- Doordash membership with a $120 credit ($60 in 2020 and $60 in 2021)

- 10x points on Lyft rides

- Priority Pass Lounge membership.

After all the benefits, the annual fee is really less than a hundred dollars. Pretty sweet. And if you already have the card and it is coming up for renewal between April 1 and July 1, Chase gave you a $100 credit to offset the new increased annual fee.

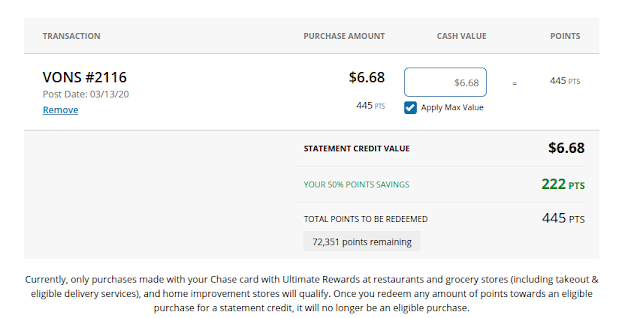

Now Chase announced that the $300 travel credit will be a $300 grocery and gas credit. It will automatically post to your account as you make purchases. Chase also announced that through September, if you want to trade in your points for cash, you will recieve 1.5 times just like if you used them in the travel portal instead of 1:1.

For the Chase Sapphire Preferred, holders can cash in their points at 1.25:1 same as the value in the travel portal. The Preferred has only a $95 annual fee, but way less perks.

So if you are looking for a long term card with tons of flexibility, don't get scared off by the hefty annual fee.