My flight from Boston to San Juan, Puerto Rico was cancelled due to strong storms this summer. Jet Blue had issued a weather waiver the day before so I was able to go on the app and switch to a flight the next day. But that meant I was spending the night in Boston. I booked a hotel with an airport shuttle and returned my rental car. After I returned home from the trip, I wondered if I could get reimbursed for this expense?

This summer, we have seen lots of travel delays. Some due to weather, others due to pilot shortages. Sometimes when your travel is delayed, you may need to get a hotel room, rental car or food. The question is how can you get reimbursed for these purchases?

Navigating Travel Delay Expense Claims

If your flight is delayed or cancelled due to maintenance issues then the airline should cover your expenses. But if the airline is not cooperating, then if you bought travel insurance, that would be the next step.

But the other option is looking at the credit card benefits you bought the flights with. Several credit cards include travel delay, interruption, and cancellation benefits. My favorites are the Chase Sapphire Reserve and Preferred, Ink and the Capital One Venture X credit cards. Let's break it down and see what they each cover.

- Chase Sapphire Preferred

- Trip Cancellation/Interruption Insurance

- Trip Delay Reimbursement

- Travel Accident Insurance

- Lost Luggage Reimbursement

- Baggage Delay Insurance

- Travel and Emergency Assistance

- Auto Rental Collision Damage Waiver

- Roadside Dispatch

- Trip Cancellation/Interruption Insurance

- Trip Delay Reimbursement

- Travel Accident Insurance

- Lost Luggage Reimbursement

- Baggage Delay Insurance

- Travel and Emergency Assistance

- Auto Rental Collision Damage Waiver

- Roadside Dispatch

- Emergency Evacuation and Transportation

- Chase Ink Business Preferred

- Auto Rental Collision Damage Waiver

- Trip Cancellation/Trip Interruption Insurance

- Travel and Emergency Assistance

- Roadside Dispatch

- Capital One Venture X

- Primary Car Rental Loss and Damage Insurance

- Trip Cancellation

- Trip Interruption

- Trip Delay Reimbursement

- Lost Luggage Reimbursement

- Travel and Emergency Assistance including translation, luggage locator and more.

- Travel Accident Insurance

**This card doesn’t have baggage delay coverage, emergency medical and dental coverage, or emergency medical transport and evacuation insurance

Navigating Travel Delay Expense Claims

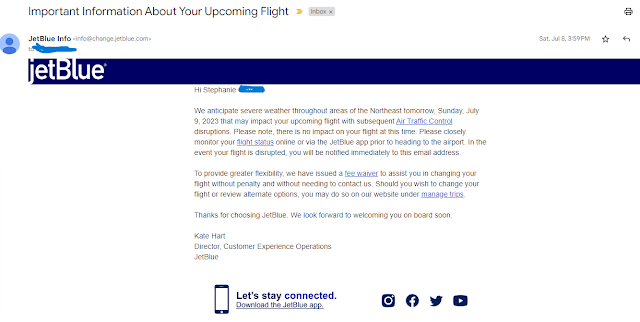

In my situation, since JetBlue cancelled my flight due to weather, the airline was not planning to reimburse me. BUT I purchased the flights with my Capital One Venture X credit card in the Capital One Travel Portal so I decided to see if the trip delay/interruption insurance would apply.

I opened a claim on this website and uploaded the requested documents. In about 5 days, I received an email asking for more documents. Several of the documents I had already uploaded, but I played along and uploaded them again.

I asked for Capital One to cover the hotel room in Boston, the airport shuttle $10 each way, and the non refundable hotel room in San Juan that I never used. Grand total $406.

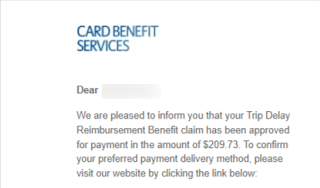

After another 5 days, I got a phone call asking for another document. I uploaded that one and 5 days later, I got an email saying that Capital One would cover the hotel room in Boston and the airport shuttle, but not the room in San Juan. Grand total $209.73. On hindsight, I may have been better off if I had used my Chase Sapphire Reserve, but I also got reimbursed for the hotel and shuttle so I call that a win.

What I learned from the process is to keep all your documentation so you can provide it and practice patience.

.png)

.png)

%20-%20chase.com.png)

.png)

.png)