Tuesday, September 26, 2023

Chase Ink No Annual Fee Card Offers Big Bonus

Tuesday, September 19, 2023

Capital One Venture X New 90,000 Point Bonus Offer

Capital One Venture X comes with a $300 annual travel credit plus $100 Global Entry credit and Capital One and Priority Pass Lounge access. You also get a 10,000 point bonus on your anniversary. All of this balances out the $395 annual fee.

I like Capital One because the points are so flexible. You can transfer them to dozens of airlines and hotels plus you can use them to erase travel purchases and to buy travel in the portal. Though sometimes you need to be careful when booking through the portal.

You earn 2 points per dollar on everything so it's a great everyday card. The 90,000 bonus offer is equal to $900 in travel.

You are only eligible for a Capital One bonus every 48 months so if you have had this card before, be sure to check the date that you got the bonus. And if you or your partner have a Capital One Venture X card, it may make more sense to refer the other person to the regular offer to get the referral bonus which is worth 25,000 points.

Sunday, September 17, 2023

How You Can Earn 5x Chase Ultimate Reward Points Using Paypal

Tuesday, September 5, 2023

Yet Another Reason Why I LOVE Chase Ultimate Rewards

Woohoo! That means by transferring CUR to Hyatt at 1:1 cuts the number of points needed in half and has a value of $740. Nice.

It's simple to transfer CUR points to dozens of airlines and hotel chains. When you log into your Chase.com account and click on redeem points

When I transferred to Hyatt, the points showed up immediately in my new Hyatt account and I could book the hotel in Evanston. Amazing!

Yet Another Reason Why I LOVE Chase Ultimate Rewards

Right now, the Chase Ink Business Preferred credit card is offering a 100,000 CUR bonus with a $8,000 minimum spend. It's a hefty minimum spend, but usually it is set at $15,000 so you might say this minimum spend is a bargain. If you have a big expense coming up or can handle the minimum spend, this bonus can be worth thousands of dollars.

We are hearing this bonus may end September 23rd.

Monday, August 28, 2023

An Easy Way To Get A Southwest Mini Companion Pass.....Fast!

And starting in October, we will talk about how to earn the pass for 2024-25.

But while you are waiting, if you are planning travel for early 2024. You might want to hop on this MINI Southwest companion pass offer.

I hopped on this offer back in 2021 to bridge the gap so to say. I got the chance to visit with a friend in Phoenix for the day and bam, earned the mini pass. I used the pass to fly to the east coast a few times in early 2022 before my real companion pass kicked in.

If you decide to hop on this offer, follow the directions carefully.

- You must register before you buy your flight. Flights you already booked do NOT count unless you register and rebook them.

- You must buy your flight. You cannot use points. My recommendation is to find an inexpensive flight.

- You must buy your flight by August 30th.

- You must travel by September 30th

Friday, August 25, 2023

Cracking the Code to Redeem 100,000 Chase Ultimate Rewards Like a Pro!

|

| Near Santiago, Chile |

- transfer them to dozens of different airline loyalty programs

- transfer them to several hotel chains (Marriott, IHG, Hyatt)

- use them to buy hotels, flights, activities and car rentals in the Chase Travel Portal

- pay yourself back for groceries, gas and the annual fee

- get a statement credit

Monday, August 21, 2023

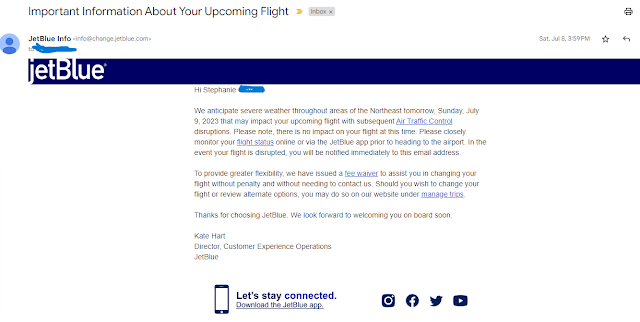

Navigating Travel Delay Expense Claims

My flight from Boston to San Juan, Puerto Rico was cancelled due to strong storms this summer. Jet Blue had issued a weather waiver the day before so I was able to go on the app and switch to a flight the next day. But that meant I was spending the night in Boston. I booked a hotel with an airport shuttle and returned my rental car. After I returned home from the trip, I wondered if I could get reimbursed for this expense?

This summer, we have seen lots of travel delays. Some due to weather, others due to pilot shortages. Sometimes when your travel is delayed, you may need to get a hotel room, rental car or food. The question is how can you get reimbursed for these purchases?

Navigating Travel Delay Expense Claims

If your flight is delayed or cancelled due to maintenance issues then the airline should cover your expenses. But if the airline is not cooperating, then if you bought travel insurance, that would be the next step.

But the other option is looking at the credit card benefits you bought the flights with. Several credit cards include travel delay, interruption, and cancellation benefits. My favorites are the Chase Sapphire Reserve and Preferred, Ink and the Capital One Venture X credit cards. Let's break it down and see what they each cover.

- Chase Sapphire Preferred

- Trip Cancellation/Interruption Insurance

- Trip Delay Reimbursement

- Travel Accident Insurance

- Lost Luggage Reimbursement

- Baggage Delay Insurance

- Travel and Emergency Assistance

- Auto Rental Collision Damage Waiver

- Roadside Dispatch

- Trip Cancellation/Interruption Insurance

- Trip Delay Reimbursement

- Travel Accident Insurance

- Lost Luggage Reimbursement

- Baggage Delay Insurance

- Travel and Emergency Assistance

- Auto Rental Collision Damage Waiver

- Roadside Dispatch

- Emergency Evacuation and Transportation

- Chase Ink Business Preferred

- Auto Rental Collision Damage Waiver

- Trip Cancellation/Trip Interruption Insurance

- Travel and Emergency Assistance

- Roadside Dispatch

- Capital One Venture X

- Primary Car Rental Loss and Damage Insurance

- Trip Cancellation

- Trip Interruption

- Trip Delay Reimbursement

- Lost Luggage Reimbursement

- Travel and Emergency Assistance including translation, luggage locator and more.

- Travel Accident Insurance

**This card doesn’t have baggage delay coverage, emergency medical and dental coverage, or emergency medical transport and evacuation insurance

Navigating Travel Delay Expense Claims

In my situation, since JetBlue cancelled my flight due to weather, the airline was not planning to reimburse me. BUT I purchased the flights with my Capital One Venture X credit card in the Capital One Travel Portal so I decided to see if the trip delay/interruption insurance would apply.

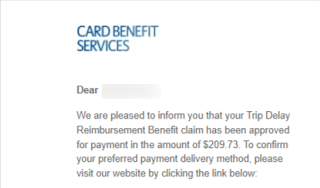

I opened a claim on this website and uploaded the requested documents. In about 5 days, I received an email asking for more documents. Several of the documents I had already uploaded, but I played along and uploaded them again.

I asked for Capital One to cover the hotel room in Boston, the airport shuttle $10 each way, and the non refundable hotel room in San Juan that I never used. Grand total $406.

On hindsight, I may have been better off if I had used my Chase Sapphire Reserve, but I also got reimbursed for the hotel and shuttle so I call that a win.

What I learned from the process is to keep all your documentation so you can provide it and practice patience.

.png)

.png)

%20-%20chase.com.png)

.png)