Tuesday, July 18, 2023

Find Out If You Qualify for a Business Credit Card!

Tuesday, June 14, 2022

How To Earn Bonus Southwest Points Fast At Hotels

How To Earn Bonus Southwest Points At Hotels

Both give you Southwest bonus points for booking through their platform and sometimes those bonuses can be huge!

How To Earn Bonus Southwest Points At Hotels

I just stayed overnight near the Baltimore Washington International Airport, that's a whole different story I will share with you in another post. So I decided to check Southwesthotels.com and bam, bonus 2,000 points for staying at the Microtel near the airport.

To get the bonus, you must book your reservation through the Rocketmiles.com app or website or Southwesthotels.com app or website. It is considered a third party booking so keep that in mind.

If you decide to open a personal or business Southwest credit card, please use my referral link to apply for your card so I can earn the companion pass and bring you amazing travel tips!

And If you want your entire trip to be FREE and/or you want to earn the companion pass, let us help you. We have teamed up with my friend and national travel blogger Lyn at Families Fly FREE. She has created a simple system to help families fly free forever.

Thursday, December 8, 2022

90,000 Chase Ultimate Reward Bonus on No Fee Ink Cards - Wow!

Small Business Saturday just passed and in honor of that, let's talk about one of the best offers I've ever seen for the Chase Ink Business credit cards. The two FREE cards are offering 90,000 Chase Ultimate Reward points as a bonus and the $95 annual fee card is offering a whopping 100,000 Chase Ultimate Reward points as a bonus. Wowza!

I'll run down the difference between the cards in a minute, but first, I have to share with you why I love Chase Ultimate Reward points and what you can do with all those bonus points.

This past summer, I took my family to Ireland, you can check out my blog to read all about this amazing country and people.

But I used Chase Ultimate Reward points to erase the cost of all of our Airbnb stays during the trip, much of our dining and one plane ticket. I love these points because of how flexible they are. You can transfer them to dozens of airlines, Hyatt, Marriott and IHG. You can erase purchases just like a Capital One card. You can buy travel with them in the Chase Travel Portal. Plus if you have a Sapphire Preferred or Reserve card, you can combine your Ink CUR points and get even more value.

So what's this new offer all about? and which card should you choose?

The Chase Ink Business Unlimited - No annual fee! 1.5% cash back or 1.5x points on every purchase.

The Chase Ink Business Cash - No annual fee! 5% cash back or 5x points at office supply stores, phone, internet, and cable. This is the card I have had for years! 2% or 2x points at gas stations and restaurants and 1% or 1x points at everything else.

The Chase Ink Business Preferred - $95 annual fee. 3% cash back or 3x points on shipping, advertising on social media sites, internet, cable and phone services and travel. 1% or 1x points on everything else.

Look at the types of purchases your business makes to determine which credit card makes sense for you to leverage your spending for maximum points. And remember, your "business" doesn't have to be a Fortune 500 company. A business can easily be selling items on Etsy or Ebay, freelance services, property management, vacation rentals and more.

You can hold all of these INK cards at the same time, but you can't get the bonus on any of these cards more than once every 24 months.

And you can transfer your the CUR points from your INK account to your Chase Sapphire Preferred or Reserve card and bam, almostFREEfamilytravel.

Amazing!

Please consider using our referral ink if you apply for any of these credit cards. Thank you for your support.

Thursday, January 11, 2024

Last Chance To Get The 90,000 Chase Ink Business Bonus

You can read about how I use Chase Ultimate Rewards points for almost FREE family travel here.

If you apply for any of the INK credit cards, please use my referral link so I can continue to help you travel for almost FREE.

If you want help walking through this process, register for my Travel Coaching Program or book me for a 1:1 coaching session.

Ends Jan. 18th

Thursday, June 20, 2019

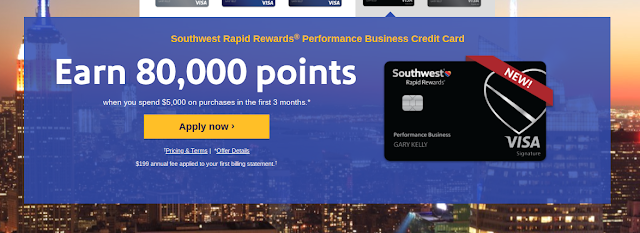

How You Can Score 80,000 Southwest Points!

Chase and Southwest Airlines just announced a new business credit card with an 80,000 point bonus! That's crazy and the highest bonus we have ever seen. Plus if you get this bonus, it puts you very close to earning a companion pass. The Southwest companion pass is one of the best travel perks around. Once you collect 110,000 points in a calendar year, you earn the companion pass or buy one get one FREE for the rest of that year and the following year.

Plus 80,000 points on Southwest can get you and your family a long way. Point values vary for flights depending on the price of the flight. But my flight from Fort Lauderdale to Havana last year only cost 2,956 points each way.

Let's break it down:

New Performance Business Credit Card

- $199 annual fee

- $5,000 minimum spend

- $100 Global Entry credit

- 9,000 points on your anniversary

- 3x points for purchases on Southwest

- 2x points for purchases on search engine, internet, cable and phone

- 1x points for purchases everywhere else

- 4 upgraded boardings

- Inflight WIFI

Saturday, December 3, 2022

Last Few Days To Apply for the 75,000 Southwest Bonus

If you haven't applied for the Southwest Airlines credit cards yet, you are running out of time. The 75,000 point bonus offer expires December 5th. If you have been following my posts, you saw that I applied for the Southwest Performance Business credit card AND the Southwest Priority personal credit card.

Monday, March 13, 2017

Starwood Personal or Business Card?

Thursday, November 17, 2022

Did You Get Approved For The Southwest Credit Cards Yet?

Tuesday, January 14, 2020

How You Can Earn The Southwest Companion Pass Fast

- Spend $1,000 for 40,000 points in the first 3 months

- Spend an additional $4,000 in six months for an additional 35,000 points

- $69 annual fee

- 3,000 anniversary bonus

- $99 annual fee

- 6,000 anniversary bonus

- $149 annual fee

- $75 Southwest credit

- 4 upgraded boardings

- 7,500 anniversary bonus

- 60,000 bonus

- $3,000 spend

- $99 annual fee

- 70,000 bonus

- $5,000 spend

- $199 annual fee

- $100 Global Entry credit

- 4 upgraded boarding passes

With all limited time offers, we do not know how long the offers will stick around, but we are hearing that this one will end February 10th. The companion pass is good for the year you earn it and the following year so the sooner you earn it, the better. Good luck and please use our referral links if you decide to apply for any Southwest credit cards.

Sunday, November 6, 2022

How The Southwest Bonus Offer Increase Plays Into Our Plan

Wednesday, November 16, 2022

It's Time To Apply To Earn The Southwest Companion Pass

Thursday, January 9, 2020

Southwest Credit Card Announces 75,000 Bonus Offer

- Spend $1,000 for 40,000 points in the first 3 months

- Spend an additional $4,000 in six months for an additional 35,000 points

- $69 annual fee

- 3,000 anniversary bonus

- $99 annual fee

- 6,000 anniversary bonus

- $149 annual fee

- $75 Southwest credit

- 4 upgraded boardings

- 7,500 anniversary bonus

- 60,000 bonus

- $3,000 spend

- $99 annual fee

- 70,000 bonus

- $5,000 spend

- $199 annual fee

- $100 Global Entry credit

- 4 upgraded boarding passes

With all limited time offers, we do not know how long the offers will stick around. The companion pass is good for the year you earn it and the following year so the sooner you earn it, the better. Good luck and please use our referral links if you decide to apply for any Southwest credit cards.

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)