- I charge all of my travel and dining to this credit card. Why?

- Currently, it earns 3x points on dining and travel. It also has amazing travel cancellation, rental and interruption insurance. I made a claim a few months ago and though it took several times uploading the same documents, they eventually reimbursed me. I always charge rental cars to this card because it earns 3x points and has awesome car rental insurance so I can pass on the insurance offered by the rental agency.

- Moving forward, it will continue to earn 3x points on dining and 4x points on travel booked directly with airlines and hotels. But other travel like car rentals, Airbnbs, and tours will only earn 1x points so that's disappointing.

- I combine all of my Chase points onto this card to use them in the Chase Travel Portal. Why?

- Currently, when you book in the portal, you earn 5x points on airlines and 10x points on hotels. When you use your points to purchase, the points are worth 1.5 in the portal.

- Moving forward, when you book in the portal, you will earn 8x points on all travel purchases booked through the portal. Current cardholders will still be able to get 1.5 value for points in the portal for a two year grace period. But the card is moving towards a "points boost" up to 2x points on certain travel purchases marked with a rocket ship. We are unsure right now how much travel will be eligible for a boost.

- $300 Travel Credit - I use this credit every year since it is automatically applied to travel purchases. Though it's not really a benefit, it does bring down the annual fee by $300.

- Moving forward, this credit will remain so it brings the annual fee down to $495.

- Global Entry credit - you can use this once every four years so it's valued at $30 per year as a benefit.

- Moving forward, this benefit remains.

- Priority Pass Lounge and Sapphire Lounge Access - remains a benefit on the Sapphire Reserve.

- Moving forward, there's no change

- Earns 5x points on Lyft and 10x points on Peloton.

- Moving forward, there's no change.

- Authorized users - price is going up from $75 to $195 per user. I don't recommend adding authorized users to any cards, but if you want to, Capital One Venture X allows you to add authorized users for free and let's them use the lounge access, but we hear this benefit may be ending.

- You could only hold one Sapphire card at a time.

- Moving forward, you can hold both cards at the same time. This could be huge! The Sapphire Preferred has an annual fee of $95 and is one of my favorite cards. I usually advise my couple clients for one person to hold the Chase Sapphire Preferred and the other to hold the Reserve. Now one person could hold both. Instead of downgrading, you can just apply for the other Sapphire card and get the welcome bonus again.

- Other new credits:

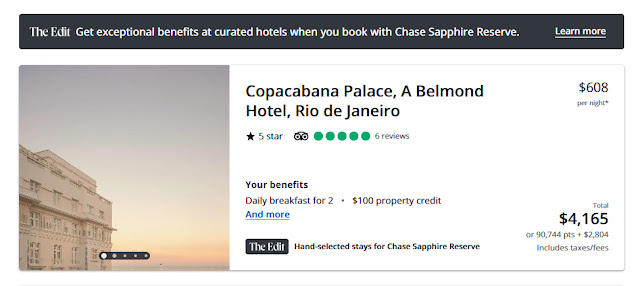

- $500 credit to use on Edit Hotels (Chase curated list).(split in two $250 credits) A quick search showed most properties were 5 star and came with perks like breakfast and $100 property credit.

- $300 credit on StubHub or Viagogo

- $300 in monthly Doordash promotions

- $300 credit at Sapphire Reserve Exclusive Tables (split in two $150 credits)

- $250 annual credit for Apple TV and Music

- $120 Doordash membership

- $120 Peloton Membership

- $120 Lyft in app credits

Want more personal help using points and miles for almost FREE travel? Join my Travel Coaching Program and we will design your personal strategy to travel for almost FREE and guide you through the process. Right now, you can use the promo code "FREETRAVEL" to get $50 off the program. Or book a 1:1 consulting call. I would love to help you make priceless family memories affordable.

*For every new client, we will donate 10% of the proceeds to one of our favorite charities.

.png)

.png)

.png)

.png)

.jpeg)