Castles, the Cliffs of Moher, Guiness and whiskey. Ireland is the land of ancient sites and the beautiful Wild Atlantic Coast and I'll be heading there with my family later this year for FREE. Woohoo!

Now, I want to share with you how I did it and how you can do it too before the offer ends on March 14th.

This one is pretty easy so here goes.

Right now,

the Capital One Venture X credit card has a 100,000 point offer with a $300 travel credit and a $200 Airbnb credit. The catch is the high minimum spend of $10,000 plus the annual fee of $395.

How You Can Score 2 Roundtrip Tickets to Europe for FREE

Before that scares you, let's talk about my secret way to eat up some of that minimum spend before you ever pay a bill.

Capital One actually gives you the bonus before you pay the credit card bill which is different than most other offers.

Which means, you can actually buy your plane tickets through the Capital One Travel Portal as soon as you get the credit card in the mail and then erase them before you ever have to make a payment if you time it right. Pretty sweet!

You will see the $300 credit go through within a few days. If we assume your plane tickets are similar to mine about $600 each r/t, then you are already $1,200 on your way towards the minimum spend.

Plus every purchase you make is 2x points so you already have 2,400 points towards FREE travel.

As long as you hit the minimum spend on your card within 90 days, which you have to in order to earn the bonus, you can erase the charge for the plane tickets.

Let's take a look at that again in steps.

3. The $395 annual fee charges to the card, it counts towards your minimum spend.

4. Charge everything to your

new Capital One Venture X card including gas, groceries, property taxes (if the convenience fee is low), tuition payments, household repairs or projects etc. You have 3 months to reach the minimum spend of $10,000.

6. Buy your flights to Europe through the Capital One Travel Portal, charge them to

the Capital One Venture X credit card Login to your Capital One account, click on travel portal, search for flights and purchase.

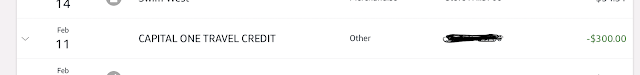

7. A few days after you buy your flights, you will see a $300 travel credit post to your account

8. When you reach the $10,000 minimum spend, you will see the 100,000 bonus points post to your account.

9. Now you should have about 120,000 points. You will erase the plane tickets by clicking on cover travel purchases. Each point is worth one cent so 124,894 points equals $1,248.

If you would like to learn more about how to fly FREE and how to earn the companion pass, we have teamed up with Families Fly FREE and would love to invite you to join the club.

Click here for more information.

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)