My family and I just returned from two weeks in Chile and Argentina. This was a redo trip from a vacation that was supposed to happen in March 2020. That trip was going to be almost FREE so the question was could we repeat it almost three years later and still do the trip for almost FREE. The answer is yes.

I believe everyone can play this game and travel for almost FREE.

I start planning big trips like this one almost two years in advance. Why so early? You need time to earn the points and miles and then the airlines open flight reservations approximately 330 days in advance. Depending on when you want to travel especially if you are looking at summer or the holidays, you need to be ready with your points/miles when those reservations open.

How You Can Vacation in South America For Pennies

For this trip, we were planning to travel over winter break. It's high season so I needed to be ready.

The first thing I do is figure out what airlines fly to the destination. In this case, I targeted American Airlines. Between American miles and Marriott points, I had collected enough miles to fly our family of five one way to Santiago, Chile. I looked at several dates and it looked like I could find flights for 30,000 miles one way from San Diego to Santiago, Chile.

You can see below if you click on the calendar, you can look at the entire month and pinpoint which days offer the best value. Right now, you could fly to Santiago for just 22,000 American miles one way.

But the return from Buenos Aires was showing 50,000 to 100,000 miles on American. The key is to be flexible with dates and cities. So I tried multiple cities and dates and nothing.

So I started looking at other airlines. I checked Avianca, United and Delta. Delta Airlines was showing returns for 25,000 miles pretty consistently.

As soon as the flights open up, I book them. Now I will book one way flights when they open and then book the return when that opens. So for two weeks, I will sit with flights to the destination and no flights home. It's a bit nerve racking, but has worked for me every time.

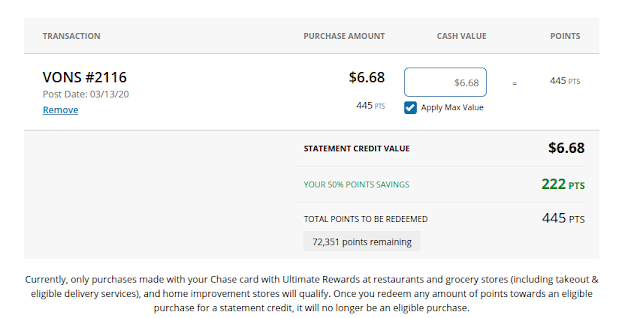

Once I secure the flights, I move onto accommodations. For our family of five with teens and young adults, Airbnb seemed like the way to go. In South America, Airbnb are very affordable and with the Chase Pay Yourself Back program allowing you to erase Airbnb purchases with points, it was a no brainer. Unfortunately, you can no longer erase Airbnb purchases with Chase points. BUT you can still erase Airbnb purchases with Capital One points.

I also leveraged some points on the Capital One Venture X credit card to erase a few travel purchases.

I will continue to erase dining purchases through the Chase Pay Yourself Back program for the next 90 days.

All in all, flights and accommodations were FREE. Some tours were FREE. Some meals and taxis will also be FREE.

Grand total for five people for two weeks in South America comes to approximately $3,000 out of pocket and that included the expensive mini trek on the glacier. If we had paid instead of using points, this trip would easily have cost $15,000. Does it take some planning? Yes. Does it take some time? Yes. But it is worth it, I think so.

That's how we do it at almost FREE family travel.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpeg)

.png)

.png)

%20(1).png)

.png)