While you are shopping for those holiday gifts, make each one count towards FREE travel. In my previous post, I shared my strategy planning for our trip to Tahiti next year.

So far, I have the flights, the overwater bungalow and garden room, plus 3.5 days in the Airbnb for FREE.

Though I earmarked the Capital One bonus points for the car rental, I still have more than 6 months to earn more points to erase that purchase.

So when I saw an additional 10% off on the Lava Tube Canyoneering day tour we want to do while there, I jumped on it and then decided to go ahead and use Capital One points to erase it.

Let's walk through that process so I can show you how valuable these points are. Some will argue you can get more value out of the points by transferring them to airlines or hotels, but my theory is like beauty, value is in the eye of the beholder. For me, erasing a $500 day tour is a good value.

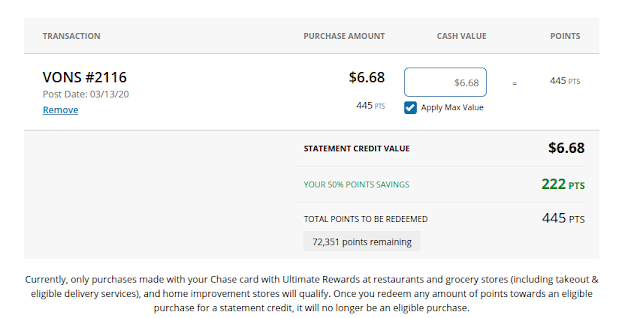

So how do you do it? First, you need to use your Capital One Venture X card to buy the tour or travel. Wait until the purchase is no longer pending and then you can click on "view rewards" and "cover purchases".

The nice thing about Capital One is that you do not have to pay for the purchase to be able to erase it. In fact, you can erase the purchase before you pay for it. AND you can use the welcome bonus BEFORE you even pay the credit card balance that helped you earn the bonus. Quite a hack.

It means you can use travel to earn the bonus and then erase the travel purchases with the bonus before you ever pay the bill. Crazy!

When you click cover purchases, all of your travel purchases will come up. You have 90 days to erase them with points. You can erase the whole purchase or part of it, but in this case, I'll erase the entire tour purchase.

It will take a few days for the purchase to drop off. You can keep ticking away at your travel purchases to get that almost FREE travel.

For me, I will be using my Capital One Venture X card for all everyday purchases because it earns 2x points to earn enough points to erase the car rental.

If you think the Capital One Venture X credit card should be part of your travel FREE strategy, please use my referral link. You will get an extra 15,000 bonus points for a total of 90,000 bonus points or $900 in FREE travel plus $300 travel credit, $100 Global Entry credit and Priority Pass Lounge Access.

Now if this is confusing or scary or you just want some help deciding if this card is right for you and your travel goals, join my travel coaching program! I am launching the second cohort now and offering a Black Friday special of just $99. This is an incredible deal because it includes the video modules, the custom points and miles tracker, a 1:1 meeting with me and our monthly group coaching sessions for life. There are limited spaces available so don't wait!

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpeg)

.png)

.png)

.png)

.png)

.png)