Tuesday, July 18, 2023

Find Out If You Qualify for a Business Credit Card!

Thursday, December 8, 2022

90,000 Chase Ultimate Reward Bonus on No Fee Ink Cards - Wow!

Small Business Saturday just passed and in honor of that, let's talk about one of the best offers I've ever seen for the Chase Ink Business credit cards. The two FREE cards are offering 90,000 Chase Ultimate Reward points as a bonus and the $95 annual fee card is offering a whopping 100,000 Chase Ultimate Reward points as a bonus. Wowza!

I'll run down the difference between the cards in a minute, but first, I have to share with you why I love Chase Ultimate Reward points and what you can do with all those bonus points.

This past summer, I took my family to Ireland, you can check out my blog to read all about this amazing country and people.

But I used Chase Ultimate Reward points to erase the cost of all of our Airbnb stays during the trip, much of our dining and one plane ticket. I love these points because of how flexible they are. You can transfer them to dozens of airlines, Hyatt, Marriott and IHG. You can erase purchases just like a Capital One card. You can buy travel with them in the Chase Travel Portal. Plus if you have a Sapphire Preferred or Reserve card, you can combine your Ink CUR points and get even more value.

So what's this new offer all about? and which card should you choose?

The Chase Ink Business Unlimited - No annual fee! 1.5% cash back or 1.5x points on every purchase.

The Chase Ink Business Cash - No annual fee! 5% cash back or 5x points at office supply stores, phone, internet, and cable. This is the card I have had for years! 2% or 2x points at gas stations and restaurants and 1% or 1x points at everything else.

The Chase Ink Business Preferred - $95 annual fee. 3% cash back or 3x points on shipping, advertising on social media sites, internet, cable and phone services and travel. 1% or 1x points on everything else.

Look at the types of purchases your business makes to determine which credit card makes sense for you to leverage your spending for maximum points. And remember, your "business" doesn't have to be a Fortune 500 company. A business can easily be selling items on Etsy or Ebay, freelance services, property management, vacation rentals and more.

You can hold all of these INK cards at the same time, but you can't get the bonus on any of these cards more than once every 24 months.

And you can transfer your the CUR points from your INK account to your Chase Sapphire Preferred or Reserve card and bam, almostFREEfamilytravel.

Amazing!

Please consider using our referral ink if you apply for any of these credit cards. Thank you for your support.

Thursday, January 11, 2024

Last Chance To Get The 90,000 Chase Ink Business Bonus

You can read about how I use Chase Ultimate Rewards points for almost FREE family travel here.

If you apply for any of the INK credit cards, please use my referral link so I can continue to help you travel for almost FREE.

If you want help walking through this process, register for my Travel Coaching Program or book me for a 1:1 coaching session.

Ends Jan. 18th

Wednesday, July 23, 2025

Have You Applied Yet?

Now that summer is in full swing, you might have some fomo watching all your friends go on fab trips or you are enjoying your trip and already planning the next one.

Either way, the new Chase Sapphire offers could help you make those vacations super affordable. We don't know when this latest offer will end so it's better not to wait.

Chase announced three whopper deals on its Sapphire line of credit cards. We will detail these for you and help you decide if you should jump on any of these offers. We knew the Chase Sapphire Reserve credit card was undergoing a refresh and you can check the details here to see how you will be affected if you already hold the card. It's good!

- Chase Sapphire Preferred - Bonus offer 75,000 points (valued at $750) with a $5,000 minimum spend in three months. This is our all time favorite travel credit card. Annual fee of $95 and it comes with a $50 hotel credit when you book through the travel portal. You earn 3x points on dining, 3x on online grocery, 2x on travel, 5x on travel booked in the Chase Travel Portal and 1x on everything else. It also comes with a $120 DoorDash credit and points boost when you book in the Chase Travel Portal.

- Chase Sapphire Reserve - Bonus offer 100,000 points (valued at $1,000) with a $5,000 minimum spend in three months. This was our all time favorite premium travel credit card, but it now has an increased annual fee of $795. We still think it's a great deal, but you need to make certain that you will use the credits to make the high annual fee worth it. We detailed the credits and benefits of the new refreshed card here.

- Chase Sapphire Reserve Business - Bonus offer 200,000 points with a $30,000 minimum spend in six months. This is a brand new card and if your business can swing the spend, it's a great deal for you. You can squeeze as much as $4,000 value out of those 200,000 points. Plus annual credits on the Chase Travel Portal, DoorDash, Zip Recruiter, Edit Hotels, Google Workspace, Lyft and more.

Want more personal help using points and miles for almost FREE travel? Join my Travel Coaching Program and we will design your personal strategy to travel for almost FREE and guide you through the process. Right now, you can use the promo code "FREETRAVEL" to get $50 off the program. Not ready to dive into th coaching program, download the ebook or custom tracker or book a 1:1 consulting call with me. I would love to help you make priceless family memories affordable.

*For every new client, we will donate 10% of the proceeds to one of our favorite charities.

Monday, June 23, 2025

New Chase Sapphire Offers Are Announced And They Are Big!

- Chase Sapphire Preferred - Bonus offer 75,000 points (valued at $750) with a $5,000 minimum spend in three months. This is our all time favorite travel credit card. Annual fee of $95 and it comes with a $50 hotel credit when you book through the travel portal. You earn 3x points on dining, 3x on online grocery, 2x on travel, 5x on travel booked in the Chase Travel Portal and 1x on everything else. It also comes with a $120 DoorDash credit and points boost when you book in the Chase Travel Portal.

- Chase Sapphire Reserve - Bonus offer 100,000 points (valued at $1,000) with a $5,000 minimum spend in three months. This was our all time favorite premium travel credit card, but it now has an increased annual fee of $795. We still think it's a great deal, but you need to make certain that you will use the credits to make the high annual fee worth it. We detailed the credits and benefits of the new refreshed card here.

- Chase Sapphire Reserve Business - Bonus offer 200,000 points with a $30,000 minimum spend in six months. This is a brand new card and if your business can swing the spend, it's a great deal for you. You can squeeze as much as $4,000 value out of those 200,000 points. Plus annual credits on the Chase Travel Portal, DoorDash, Zip Recruiter, Edit Hotels, Google Workspace, Lyft and more.

Want more personal help using points and miles for almost FREE travel? Join my Travel Coaching Program and we will design your personal strategy to travel for almost FREE and guide you through the process. Right now, you can use the promo code "FREETRAVEL" to get $50 off the program. Or book a 1:1 consulting call. I would love to help you make priceless family memories affordable.

*For every new client, we will donate 10% of the proceeds to one of our favorite charities.

Thursday, July 13, 2023

How To Squeeze More Value Out Of Your CUR Points

The Chase Ink Business Preferred and the Sapphire Preferred gives you 25% more for your points in the pay yourself back and Chase Travel Portal, but the Chase Sapphire Reserve gives you 50% more.

How To Squeeze More Value Out Of Your CUR Points

So here's the secret. Chase allows you to combine your points from one credit card to another. So you can easily move your points from your FREEDOM FLEX or Unlimited card to your Sapphire Preferred or Chase Sapphire Reserve to get more value.

- Just log into your Chase.com account

- Click on the earn/use points and you'll see this dashboard. It's expanded a lot since the pandemic started. One of the things I love about Chase is how user friendly the site is. You can see exactly how many points you have, how to use them, and how to earn them.

- Click on combine points and you will see the option to move points from one card to another. You can also move points from one family member to another if your family member only has a no fee card or even a Preferred card.

Chase will ask you how many points you want to move, review your order and bam, instant transfer.

How To Squeeze More Value Out Of Your CUR Points

Now you can use those points for travel or to pay yourself back for any qualified purchases you made in the past 90 days.

If you decide to apply for the Chase FREEDOM Flex, Sapphire Preferred, Sapphire Reserve or Business Ink please consider using my referral link. You get the same bonus and I also get a small bonus for referring you. That's how we do it at almostFREEfamilytravel.com

Wednesday, February 8, 2023

Is The New Southwest Companion Pass Offer Right For You?

Friday, January 27, 2023

Chase Launches Biggest Bonus Offer Ever On IHG

- Holiday Inn

- Holiday Inn Express

- Crowne Plaza

- Kimpton

- Regent

- Intercontinental

- Even

- Voco

- Hotel Indigo

- Avid

- Staybridge Suites

- Candlewood Suites

- Atwell Suites

- Holiday Inn Vacation Club

- Hualuxe

- Vignette Collection

- Six Senses

- $3,000 minimum spend in three months

- 175,000 IHG bonus points

- $99 annual fee

- $100 Global Entry credit

- Complimentary Platinum Elite status

- FREE night on your anniversary up to 40,000 points

- $50 United Travel Bank credit

Tuesday, June 9, 2020

How To Pay Yourself Back With Chase

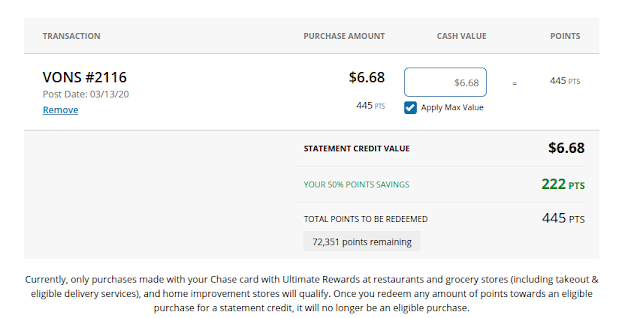

An exciting new perk offered by Chase Sapphire Reserve and Preferred credit cards is the option to pay yourself back with your points.

How To Pay Yourself Back With Chase

The beauty here is that you still earn the Ultimate Reward points on your grocery, home improvement, or dining purchase and then you erase it with the extra value. When you book travel through the Chase portal, you also get the extra value, but you don't earn Chase points and you don't earn airline miles or hotel points. That's because Chase uses Expedia as its portal so you are making your reservation through a third party.

You have 90 days after your purchase to essentially erase it with points and you can pick and choose from the list.

1. Log in to your Chase account

2. Click on redeem points

3. Click on earn/use points at the top left of the screen

4. Click on pay yourself back

At this point, since you might not be traveling, it might make more sense to erase grocery, home improvement, and dining purchases and then buy your travel. You get the bonus when you erase those purchases and then you double dip by getting points again when you pay for your travel. If you decide to apply for the Chase Preferred credit card, please consider using my referral link and supporting my blog. Right now, you can get 50,000 points when you spend $4,000 in the first 3 months. That's about $625 in travel, groceries, home improvement or dining. Awesome!

Thursday, October 31, 2024

What Is A Transfer Bonus And How Can It Mean Big Savings For You

- Heathrow to LAX for just 9,000 Virgin points.

- Login to your Chase.com account

- Click on redeem points

- Hover over travel and click on transfer to travel partners

- Click on the partner you want to transfer points TO

- Enter your membership information

- Your name must match exactly!

- Enter the number of points you want to transfer (must be in increments of 1,000)

- Confirm

- The transfer should happen almost immediately

Tuesday, September 26, 2023

Chase Ink No Annual Fee Card Offers Big Bonus

Tuesday, September 5, 2023

Yet Another Reason Why I LOVE Chase Ultimate Rewards

Woohoo! That means by transferring CUR to Hyatt at 1:1 cuts the number of points needed in half and has a value of $740. Nice.

It's simple to transfer CUR points to dozens of airlines and hotel chains. When you log into your Chase.com account and click on redeem points

When I transferred to Hyatt, the points showed up immediately in my new Hyatt account and I could book the hotel in Evanston. Amazing!

Yet Another Reason Why I LOVE Chase Ultimate Rewards

Right now, the Chase Ink Business Preferred credit card is offering a 100,000 CUR bonus with a $8,000 minimum spend. It's a hefty minimum spend, but usually it is set at $15,000 so you might say this minimum spend is a bargain. If you have a big expense coming up or can handle the minimum spend, this bonus can be worth thousands of dollars.

We are hearing this bonus may end September 23rd.

.png)

.png)

%20Facebook%20(18).png)

.png)

%20-%20chase.com.png)

.png)